The one thing the US sports betting industry doesn’t have is a supply problem. Yes, some states have restricted access or created monopolies, but with more than 50 unique brands operating in the US, the national landscape is highly competitive with a premium on market access.

But, market access doesn’t guarantee success. Like a late-night infomercial, individual results may vary.

According to a recent Eilers & Krejcik Gaming’s Sports Betting Market Monitor, only seven of the 55 sports betting brands possessed a national market share above 1%, with the top four brands accounting for a whopping 87% of the market.

That disparity is striking and raises a lot of questions. Like, can a fifth operator break into the upper echelon?

Categorizing US Sportsbooks

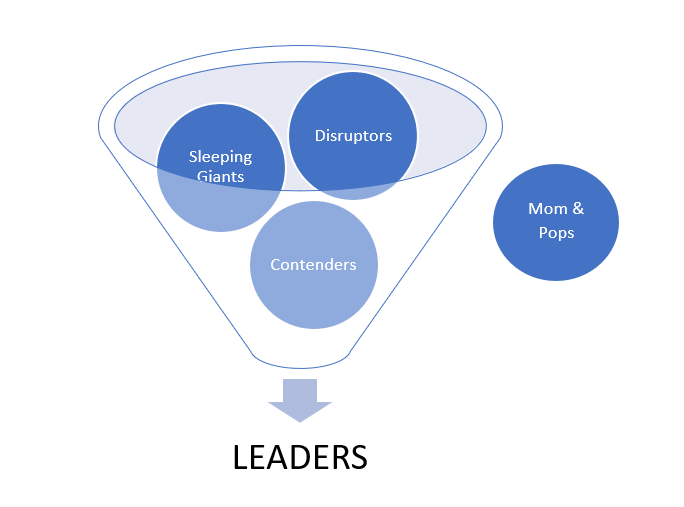

We can break the US sports betting industry into five categories:

- The Leaders

- The Contenders

- The Disrupters

- The Mom & Pops

- The Sleeping Giants

On the micro-level, the way every operator approaches the US sports betting space is unique. On the macro level, each category requires operators to employ specific strategies.

Other than the Leaders, everyone hopes these categories are fluid.

Contenders are trying to supplant or join the Leaders by carving out market share.

The goal for Disruptors and Sleeping Giants is to move into the Leader category, which usually requires a stop in the Contenders category.

Mom & Pops, or local heroes as they’ve been called, don’t have the desire or resources to jump categories. These are local brands that lack a national footprint.

Leaders: Four Companies Filling Five Spots

The four companies accounting for 87% of national revenue are FanDuel, DraftKings, BetMGM, and Caesars. Three of these companies are solidly in the leader category, with Caesars being the most vulnerable.

Operators in this category want to extend their lead until they feel they can safely pull the ladder up behind them and rein in their spending. The ladder, in this case, is a willingness to spend money.

Pulling the ladder up too soon opens the door for competitors to battle in a less burdensome market where a willingness to spend absurd amounts is no longer a prerequisite to success. Until the leaders believe there are no threats in the rearview mirror, the ladder stays down, making it impossible for smaller companies to compete. As we’ve seen with Caesars, some companies will leave that ladder down longer than others.

These four operators understand they won’t be allowed monopoly or duopoly control of the US sports betting market. They can’t keep every competitor out, but if they have their way, it will be a specific type of operator that focuses on local markets, the Mom & Pops.

Leaders want to eliminate contenders. They don’t want to see any Disruptors. And they especially don’t want any Sleeping Giants coming into their territory.

Contenders: Battling For The Final Leader Spot

Currently, three contenders are vying for the unoccupied Number 5 spot in the Leader category, Barstool, PointsBet, and BetRivers. All three are active in at least ten states and feel they have what it takes to compete.

Being a Contender is good, but operators in this category have the unenviable task of protecting two flanks. They must defend their current position while looking for avenues into the Leader category.

Interestingly, Barstool (at least for now) and BetRivers operate on the Kambi platform, while PointsBet utilizes a proprietary platform.

PointsBet still feels like more of a potential acquisition target. Meanwhile, BetRivers is taking a long-term approach to the market and is unwilling to behave like the companies in the Leader category.

Of the three, Barstool-Penn National seems to have the best opportunity to separate itself and land in the Leader category. Its fate is primarily tied to the company’s migration to the theScore platform. Its current platform is well-received, so the move needs to be 1) an improvement and 2) free up money the company can use elsewhere.

Disruptors: Blazing A New Path

Disruptors are companies that have a unique approach or products.

Good examples of Disruptors are Fubo with its media, Circa Sports with its appeal to professional and big-time bettors, and Smarkets, which is acting as a traditional sportsbook in the US but is best known for its exchange betting platform.

The trick for Disruptors is scale. Most often, if the product is good enough or gaining enough traction, it can be mimicked or bought and absorbed by one of the leaders.

Sleeping Giants: Waiting In The Wings

Sleeping Giants are why the DraftKings and FanDuels of the world still have anxiety. Some of these companies are simply sitting on the sideline. Other companies in this category have positioned all of their pieces but haven’t launched a full assault. And still, others are a brand without a sportsbook.

Some companies in this category are Bally Bet, Bet365, Fanatics, and companies like Walt Disney and ESPN.

Bottom Line

The US sports betting market is shaking out, but there is still a long way to go. We’re in the second quarter of a four-quarter game.