There was some big news in the North American sports betting space as Pinnacle, one of the best-known brands in sports betting, was granted a license from the Alcohol and Gaming Commission of Ontario (AGCO). The significance of Pinnacle’s licensure cannot be understated, as the longtime gray market sportsbook is seen as a line of demarcation between the post-PASPA sports betting industry and its offshore predecessor.

Of all the offshore operators, Pinnacle has the best reputation, so it’s not surprising they are the first major offshore brand to shift into the legal North American market. The big questions are, will Pinnacle’s Ontario license help the company in the US, and will other gray and black-market operators follow Pinnacle into the legal markets?

There were already hints that some offshore operators were sniffing around the legal US industry. Before the Pinnacle news, there was a partnership between BetCris and the NFL and the rumors of 5Dimes settling with the US government with the intention of using it as a springboard to a US license.

Who Is Pinnacle?

If your experience with sports betting began with the Supreme Court’s May 2018 decision that struck down the Amateur and Professional Sports Protection Act (PASPA), you likely have heard of but don’t know much about Pinnacle.

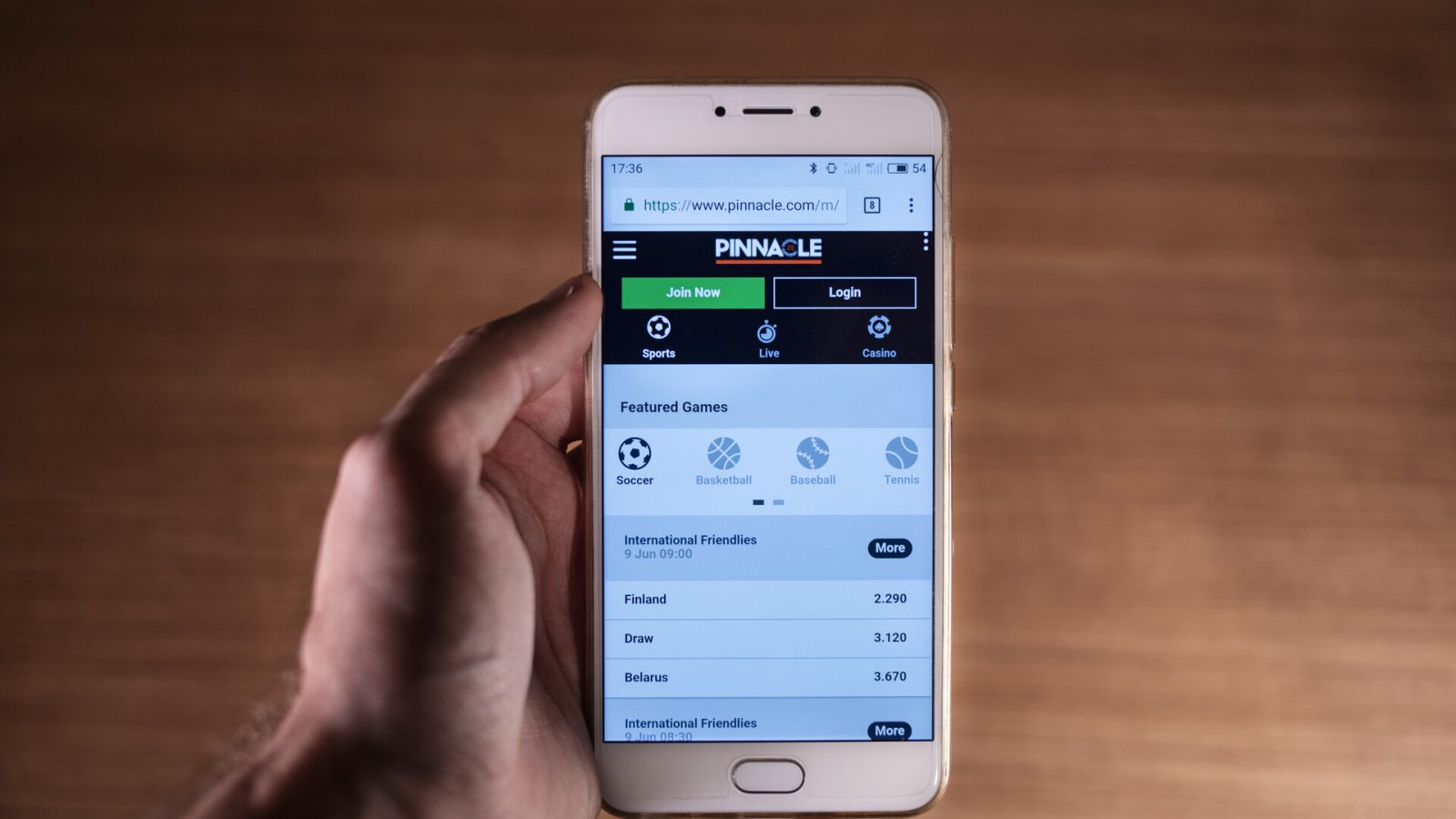

Pinnacle wasn’t the first online sportsbook, but it wasn’t too far behind (Pinnacle Sports launched in 1998) the sites that popped up in the mid-1990s. Since its inception, Pinnacle has done things differently, eschewing bonuses and promotions. Instead, it has focused on being a leader in pricing, and is seen as one of, if not the most influential books regarding shaping lines.

Pinnacle was always a popular US sportsbook. While many of its competitors continued to operate in the US, Pinnacle exited the market in January 2007, following the passage of the Unlawful Internet Gambling Enforcement Act (UIGEA). Pinnacle’s decision to withdraw from the US in 2007 certainly helped the company make its case for licensure in the present day.

That case will be more difficult for others, but based on the last ten years of legal online gambling in the US, the barriers may be easier to scale than one would think.

Don’t Forget to Close the Door Behind You

The legal market is supposed to be different, but as most of gambling Twitter will tell you, the licensed operators and the offshores are two sides of the same coin. The most significant difference between these companies isn’t what they do. Instead, it’s when they left the US.

If we turn to online poker for comparison, the legal US market has three main operators:

- PokerStars

- 888/WSOP.com

- Partypoker

Like Pinnacle, 888 and partypoker left the US following the passage of UIGEA. PokerStars didn’t. It stayed in the US until 2011, when the DOJ forced the company (and a couple of its peers) to stop operating in the US.

PokerStars’ decision to stick around an extra five years had consequences. PokerStars is blacklisted in Nevada, and New Jersey regulators gave the company a timeout before they were allowed to launch. That said, they are licensed in several US jurisdictions.

Further, 888 and partypoker were operating in the US before UIGEA, and UIGEA did not change the legality of offering online poker in the US. All it did was increase payment processing enforcement for online gambling transactions.

And then there are the numerous employees and executives that have moved from offshore companies to publicly traded international gambling giants. And then there are all the affiliates currently licensed in US jurisdictions, many of whom were marketing offshore sites as recently as a few years ago.

The point is past offenses aren’t a Scarlet Letter. They are more of a temporary tattoo. And Pinnacle’s Ontario license is likely going to open the door for other offshore operators, assuming these licensed markets interest them.